Germany's new export credit guidelines to boost clean energy investment

Unsplash / Matthew Cassidy

A joint blog post by E3G and Germanwatch, by Ysanne Choksey and Anja Gebel.

- Germany’s Federal Ministry for Economic Affairs and Climate Action has announced new climate related sector guidelines for export credit guarantees and investment guarantees that would prevent support for almost all new fossil fuel projects from 1 November onwards.

- A limited number of gas projects may still receive support if they fulfil national security requirements or prove they can aid short term supply shortages, which is unlikely to be the case.

- Third countries are concerned about the potential drop in investment; this should be addressed by investing the billions now saved from servicing fossil fuel projects in clean energy instead.

On Thursday, 12 October, the government announced climate-related sector guidelines governing how the country supports exporters. Euler Hermes, Germany’s export credit agency, provided over EUR 100 billion in support for German exporters in 2022, more than any other export credit agency.

After consulting with industry and civil society actors over the summer, government decided on new climate policy guidelines that exclude almost all fossil fuel projects from 1 November onwards. The new policy will apply to all projects that have yet to receive export credit guarantees or investment guarantees from Euler Hermes.

At the beginning of this year, Euler Hermes still had ten fossil fuel project applications in Brazil, Iraq, Uzbekistan, the Dominican Republic, and Cuba pending. These projects together were worth around EUR 1 billion in export credit support. Euler Hermes must now carefully check those projects against the new policy.

This is an important demonstration of leadership ahead of COP28; Germany is finally implementing its commitment at COP26 in Glasgow. Signatories to the Glasgow Statement, 39 in total, pledged to remove public financial support for international fossil fuel projects and to prioritise development of renewables. The Green Minister for Economic Affairs, Robert Habeck, is now implementing a commitment made under Chancellor Merkel, a conservative, to an initiative led by former conservative UK Prime Minister Boris Johnson.

A notable exemption though will be made until 2025 for new gas projects that prove indispensable for geostrategic energy supply security or national security. The exemption though is unlikely to be used if properly assessed; new projects typically have a time-lag of up to ten years, out of scope for acute gas supply shortages. However, this decision sends conflicting messages to the rest of the world, left in the dark about Germany’s future needs for fossil fuels.

Understandably, German industry is worried about losing out on international markets. However, the way forward to remain competitive is to invest in green infrastructure and technology. The German sector guidelines are by no means a singular effort, but part of a long overdue international turn to green markets. The IEA’s World Energy Outlook report from October 2023, forecasts unstoppable renewables growth under even existing policies. And all fossil fuels are set to peak under these policies as well, signalling an end to that sector’s growth.

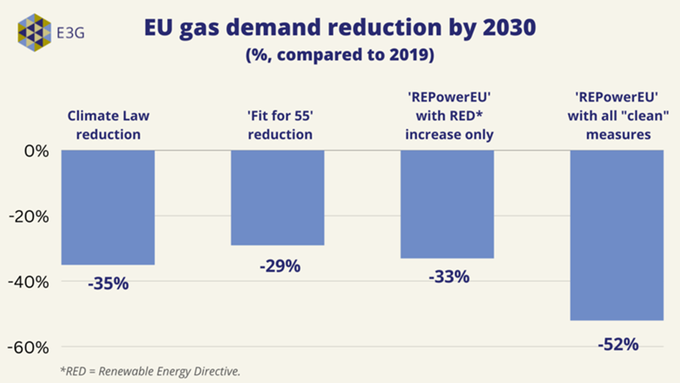

Germany needs to be much more upfront with its international partners about its role as a major player in the EU’s commitment under RePowerEU to reduce gas demand by 30 to 50% by 2030. Supporting gas infrastructure abroad would send a contradictory message to those noting gas demand reduction in the EU.

Keeping pace internationally and to address legitimate concerns about removing financial support for fossil fuels, Germany should follow up with strong commitments on how it will close the clean energy investment gap through its engagement in ongoing negotiations on Just Energy Transition Partnerships and broader International Financial Architecture Reform. Germany should also make clear that this is just the first step the government is making to shift all international investments towards green markets. Looking forward, Germany’s National Development Bank KfW should demonstrate similar leadership with an ambitious climate policy.

This post is also published on E3G's blog.

Author(s)Ysanne Choksey (E3G) Anja Gebel (Germanwatch) |