The year 2019 will be key for future climate policy in Germany and Europe. Finance plays a key role in improving climate protection and sustainable growth.

To this end, Germany should learn from pioneering countries for "Green Finance". In the seven articles in our series, international authors will therefore explain their country's approach towards a green financial system, addressing opportunities, hurdles and unanswered questions.

Climate Risk Disclosure: France Paves the Way

Already in 2015, France adopted a law on climate risk disclosure paving the way for protecting economic systems from the consequences of climate change. But others need to follow.

Financial institutions and governments around the world are acknowledging the importance of climate change on the sustainable finance agenda. The World Economic Forum identified climate change-related risks as the top three most likely global risks for 2019, followed by data fraud and cyber attacks, and as four out of the top five most impactful risks, after weapons of mass destruction. This underscores the importance of building economies resilient to climate change impacts.

In 2015, just before the 21st Conference of the Parties (COP21) and the Paris Agreement, France became the first country to pass a law requiring publicly listed companies, institutional investors and asset managers to report their climate-related risks, including both transition risks (associated with the transition to a low carbon economy) and physical risks (associated with extreme weather events or chronic stresses affecting businesses and economic assets).

While today’s conversations about the Paris Agreement and sustainable finance require a transition to a low carbon economy, governments have realized that they also require discussion of the economic risks of physical climate impacts that will occur whether or not Paris climate targets are met. Reaching the adaptation goals of the Paris Agreement requires catalyzing investment in climate resilience. Increasing transparency on companies’ and investors’ exposure to physical climate risk is an essential first step towards identifying opportunities to invest in adaptation and build resilience.

The Approach: Comply or Explain

The French Energy Transition Law and its Art. 173 laid the regulatory groundwork for integrating climate risk transparency into the national sustainable finance approach. The regulation uses a comply or explain approach, providing flexibility for how firms disclose their risks and allowing firms to opt-out from reporting, with an explanation. This fosters discussions among investors, insurers and businesses to find the most informative and feasible risk analysis and reporting methodology across sectors.

The Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) released its final recommendations for climate-related disclosures in June 2017. These voluntary recommendations provided additional direction on how to disclose climate risks, but still do not provide concrete metrics. French organizations, such as Finance for Tomorrow and I4CE, the Institute for Climate Economics, help to catalyze continued research on this topic and keep climate on the sustainable finance agenda.

International initiatives also help facilitate ongoing thought leadership: for example the report Advancing TCFD Guidance on Physical Climate Risks and Opportunities prepared by the European Bank for Reconstruction and Development and the Global Center for Excellence on Climate Adaptation, based on working groups of financial sector experts. While data providers, such as Four Twenty Seven, help to fill data gaps by providing asset-level data on climate risk exposure, there will continue to be ongoing conversations about how best to incorporate this information into actionable disclosures.

Other countries follow the example of France

Art. 173 has helped to center the Paris marketplace in the landscape of green finance. Action on climate risk disclosure continues to increase both within France and internationally. Influential financial actors are beginning to report their own risk exposure, encouraging the market to follow suit. The French Central Bank (Banque de France) for example, released a comprehensive analyses of physical and transition risk in its portfolios in compliance with Art. 173 and TCFD, aiming to set an example for emerging best practices for disclosure. The Dutch Central Bank assessed the exposure of its financial sector to water stress and other environmental risks. Countries such as Spain and Sweden have voiced their support of the TCFD and their consideration of legislation similar to Art. 173, and in July 2018 the Italian insurance supervisor IVASS released a comprehensive reporting requirement for Environmental Social Governance (ESG) risks, including climate change.

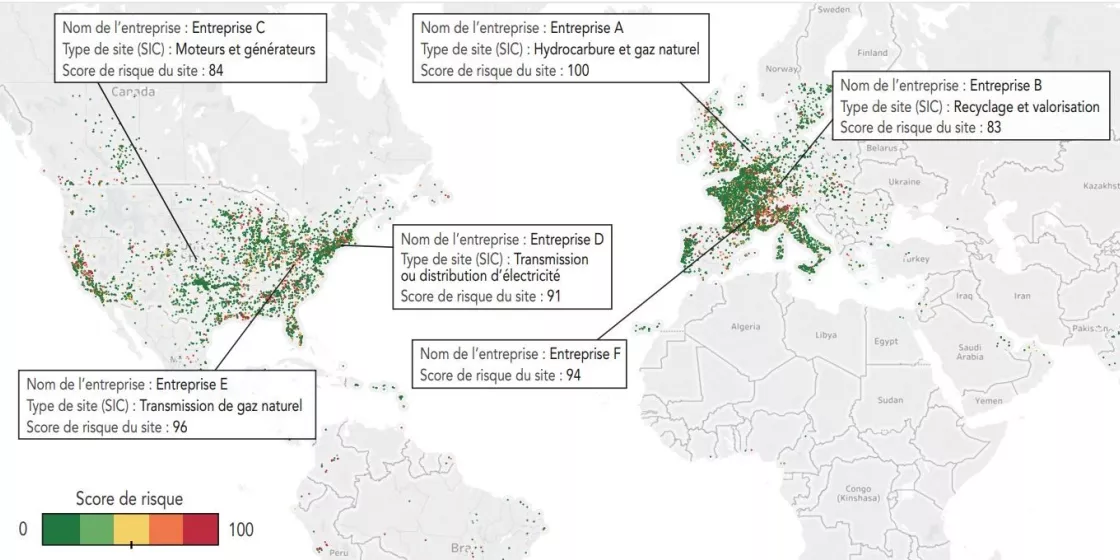

Map of flood risk exposure in facilities owned by utility companies in Banque de France’s pension fund portfolio. Red dots represent the most exposed facilities, while green dots represent those with the lowest exposure. Source: Four Twenty Seven, as published in Rapport d’investissement responsible de la Banque de France 2018.

In early 2018, the European Commission published an Action Plan: Financing Sustainable Growth, outlining ten actions with timelines by the end of 2019. This led to the development of a Technical Expert Group, which has four workstreams underway: developing a sustainable finance taxonomy, integrating climate change into non-financial reporting requirements, creating a green bond standard and creating carbon indices standards.

Art. 173 mandates an assessment of reporting progress made during the first two years of its application. This review may lead to more explicit guidance on reporting methodologies, potentially expanding the directive to apply to more actors. This, alongside increasing regulatory and investor pressure, will propel the continued improvement of physical climate risk disclosure. As uptake of climate risk and opportunity disclosure increases and is integrated into financial decision-making, France, along with other nations, will make important progress on building more sustainable economies.

Foto: Four Twenty Seven | Natalie Ambrosio, Editor At Four Twenty Seven, Natalie manages publications and communications, specializing in distilling technical information into actionable insights and analyses. She leverages her background in climate adaptation, communications and environmental sciences to inform a wide range of audiences on scientific research and data that supports resilience-building across sectors. Previously, Natalie worked at the Notre Dame Global Adaptation Initiative (ND-GAIN) where she helped to develop a nationwide assessment of cities’ vulnerabilities to climate change and their readiness to adapt. |

Foto: Four Twenty Seven | Léonie Chatain, Climate Risk Senior Analyst Léonie works in Four Twenty Seven’s Paris office, supporting analysis of physical climate risk in financial portfolios, researching climate risk and resilience in cities and helping clients understand the implications of climate change for their operations. Léonie has a background in political sciences and urban data analysis and previously provided consulting on urban sustainability for a French construction firm. |

With the financial support of Stiftung Mercator. The author and Germanwatch are responsible for the content.

The blog post was first published at www.klimareporter.de.