The year 2019 will be key for future climate policy in Germany and Europe. Finance plays a key role in improving climate protection and sustainable growth.

To this end, Germany should learn from pioneering countries for "Green Finance". In the seven articles in our series, international authors will therefore explain their country's approach towards a green financial system, addressing opportunities, hurdles and unanswered questions.

For Canada, the concept of a sustainable finance is still relatively new. But its importance is growing steadily and can become a model of success for the country.

Today, the term sustainable finance refers mainly to public and private funds earmarked to support a transition to low-carbon and resilient economy. This consists of funding activities to mitigate climate change and adapt to a new climate reality in the near- and long-term.

Sustainable finance is relatively new for the Canadian market. At this time, Canada is assessing the level of awareness of sustainable finance-related activities in its financial markets and potential steps forward.

In the last year, the Canadian financial sector’s stakeholders have explored how climate change should be incorporated into decision making and financial reporting. In the spring of 2018, the Minister of the Environment and Climate Change and the Minister of Finance established Canada’s Federal Expert Panel on Sustainable Finance.

The panel was tasked with engaging the financial sector on sustainable finance, build awareness, and encourage dialogue. In the fall of 2018, the panel produced an interim report summarizing the current state of sustainable finance in Canada. The panel continues to explore key issues through consultations across Canada and is set to release its final report later this year.

The importance of climate change risk and its potential financial implications for the Canadian economy are becoming increasingly clear. The Bank of Canada first recognized the systemic nature of climate impacts on the Canadian economy and the need to address this risk in early 2017.

Definition as Key Element

Two years later, on March 27, 2019, the nation's central bank announced that it will be joining the Network for Greening the Financial System and is commitment to “better understand the implications of climate change for the economy and the financial system”.

Beyond the obvious need to have more ambitious, consistent, and reliable policies to achieve progress in sustainable finance, the markets can also push for change. One of the key foundational elements that is catching momentum is climate-related financial disclosure.

Since the Task Force on Climate-related Financial Disclosure (TCFD) of the Financial Stability Board released its recommendations, 33 Canadian entities, the majority of which are financial institutions, have officially supported the recommendations. The regulatory board of the Canadian capital markets, Canadian Securities Association (CSA), has also made it clear that they see the need for the enhancement of climate-related disclosure.

Furthermore, Canada’s largest market exchange, The Toronto Stock Exchange (TSX), just joined the United Nations Sustainable Stock Exchanges (SSE) initiative that promotes and encourages non-financial disclosure. Some firms have started using the TCFD framework for climate-related financial disclosure in their public reporting and are actively engaged in further development of this practice.

Another key element, that is as equally if not more important, is determining what is a consistent, transparent, and practical definition for a sustainable or climate-friendly action. It is the key ingredient for operationalising the transition to a low-carbon and resilient economy in line with the Paris Agreement.

However, each jurisdiction has a unique economy with different perspectives on possible pathways to transition. Specifically, for Canada, understanding how it will transition its carbon intensive economy will be key.

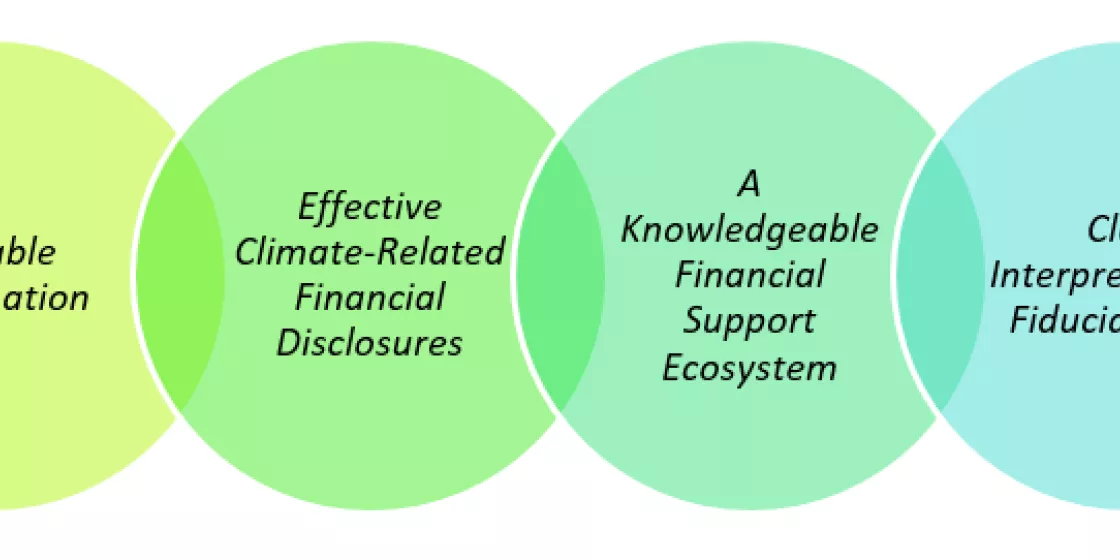

Foundation Elements of Sustainable Finance, Interim Report of the Expert Panel on Sustainable Finance

Canada’s panel on sustainable finance identified the gap in existing and emerging sustainable classification systems from other jurisdictions that do not address transition activities for emissions intensive industries.

The panel said this could hinder acceptance of sustainable finance in Canada. There is an urgent need for Canada’s participation in development of sustainable finance-related definitions and standards.

New Financial Products

It has been estimated that by 2025 the Canadian financial sector can gain between $27 and $110 billion annually from sustainable finance-related activities. The panel’s consultations produced a short list of opportunities that have potential to be both economically beneficial and to significantly contribute to Canada’s climate ambition.

These opportunities include retrofits of existing building sector, fulfilling on Canada’s infrastructure gap, transforming energy systems, adding a climate or sustainability lens to asset management and new financial products that support the transition to a low carbon and resilient economy. Indeed, there is much to gain for Canada!

Foto: Mantle314 | Olena Kholodova, Senior Advisor for Climate Change and Sustainability at Mantle314. |

With the financial support of Stiftung Mercator. The author and Germanwatch are responsible for the content.

The blog post was first published at www.klimareporter.de and availible in German.