The world needs to respond to the emergencies of climate change and the extinction of species. This entails a comprehensive socio-ecological restructuring to achieve greenhouse gas neutrality and a sustainable economy. Sustainable Finance has a key role to play in this transformation.

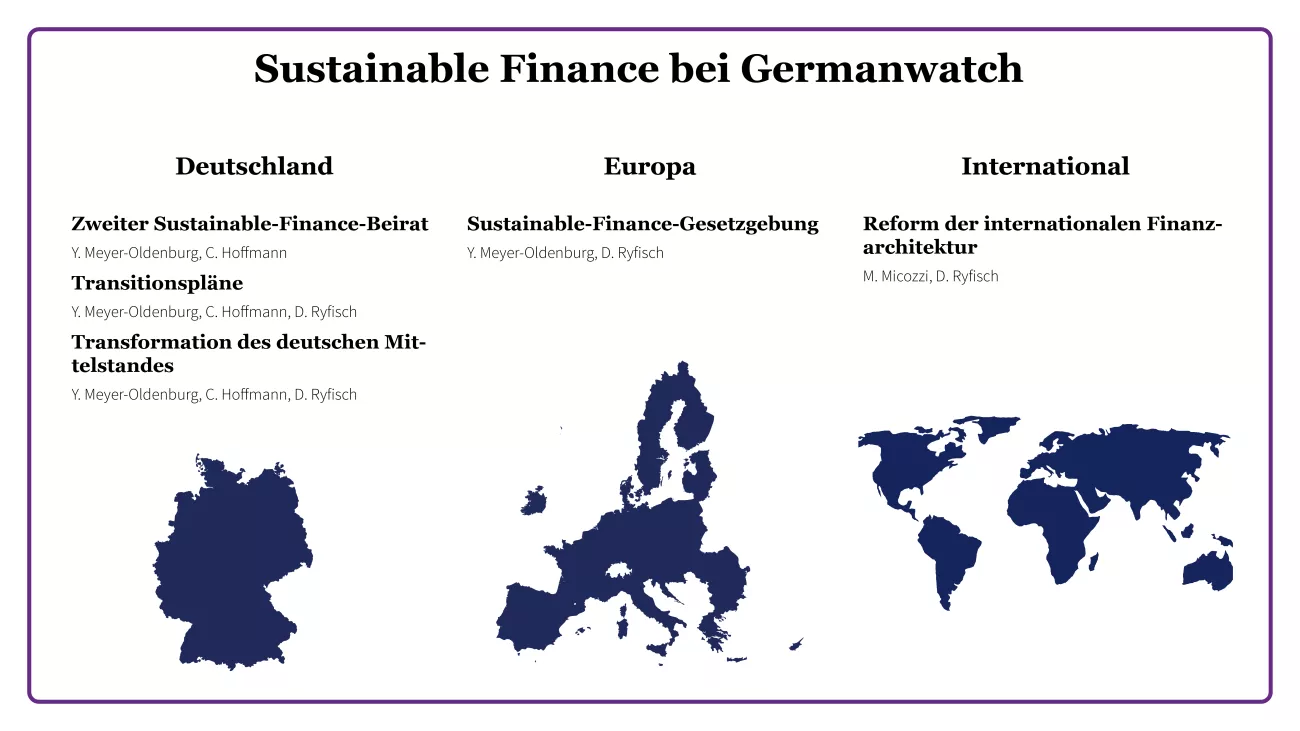

The transformation will fundamentally change economic structures and their production and consumption patterns. The financial system leverages change as a provider of capital for the real economy. For example, it provides companies with financial capital in a relatively easy and cheap manner. Sustainable Finance requires sustainability definitions and transparency regulations in line with systematic scientific standards. Sustainable Finance activities at Germanwatch promote these concerns with a focus on German, European, and international Sustainable Finance strategies. Germanwatch as a civil society organisation working on environmental and development issues contributes to the political and economic processes necessary for transformation.

Related content

Blog posts on the topic Sustainable Finance:

▸Die EU verabschiedet den ersten Teil der EU-Taxonomie im Bereich Klimaschutz

▸Sustainable Finance – Aufwertung, doch Transformationskraft kann sich noch nicht entfalten

▸Sustainable Finance as a transformation boost

Related topics and projects

Observer in the second Sustainable Finance Advisory Committee

The second Sustainable Finance Advisory Committee is a multi-stakeholder body consisting of actors from the financial and real economy, civil society, and academia. The Committee convened for its inaugural meeting in the summer of 2022. Appointed for the current legislative period, the ‘Sustainable Finance Advisory Committee 2.0’ will advise the federal government on a variety of issues, including the revision and further development of the first German Sustainable Finance Strategy.

Germanwatch participates in the Committee as an observer. Concrete activities are focused on the working groups dealing with transition plans and the transformation of small and medium-sized enterprises (SMEs) in Germany. Germanwatch also aims to promote cross-cutting issues in other working groups. Christoph Bals, policy director at Germanwatch, had been a voting member of the first Sustainable Finance Advisory Committee. His recommendations in the final report 2021 have laid a solid foundation for Sustainable Finance in Germany.

Transition plans

Transition plans are key instruments for the economic transformation towards sustainability. A transition plan sets out how, when, and through which means a company or actor from the financial market or real sector will achieve climate neutrality or in other ways respect planetary boundaries. Transition plans are therefore highly relevant for various stakeholders:

- A transition plan can support companies in achieving targets and in generating transition finance (from the capital market and potentially government funding). It also serves strategic planning and risk management.

- Financial market actors can use transition plans to assess the readiness and ability of companies to achieve transition and thus align their portfolio for sustainable investments. Transition plans are therefore essential to overcome the ‘tragedy of the horizon’ of the financial market. Additionally, drafting a transition plan enables financial market actors to set up a strategy for their own transition.

- In the future, government funding may require a science-based transition plan and thus accelerate transformation.

- Civil society can use transition plans to assess the ambitions of companies and financial market actors.

Germanwatch advocates for the establishment of transition plans as a transformation tool at the German and European level. Germanwatch is involved in the conceptualisation of transition plans, for example in the Sustainable Finance Advisory Committee, and keeps contact with decision-makers in ministries and parliaments.

Transformation of the German ‘Mittelstand’

SMEs account for more than 90 per cent of companies in Germany and are therefore often referred to as the backbone of the German economy. Many of those companies are characterised by a high degree of specialisation and a particularly high level of (international) competitiveness. In combination with a high overall share of German value creation, this makes SMEs particularly relevant to the transformation of Germany as a centre of commerce and industry. However, a rapid and far-reaching transformation is more difficult for SMEs than for large companies, especially with limited resources.

Germanwatch is supporting the transformation of German SMEs both within and outside the Sustainable Finance Advisory Committee.

Sustainable Finance Legislation

Reporting and disclosure obligations for companies and financial market actors are crucial for sustainable finance to achieve its leverage and steering effect. In addition to disclosure under the EU Taxonomy and the Sustainable Finance Reporting Directive, the Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) are essential building blocks for effective sustainability reporting at the European level. Following the adoption of the European Sustainability Reporting Standards (ESRS) by the European Commission in 2023, both the CSRD and the EU taxonomy are now being incorporated into national law, and companies in the EU have taken first steps to implement them. From a critical, civil society perspective, Germanwatch is monitoring this process in order to ensure both an appropriate implementation of the reporting obligations and the necessary support for companies to fulfil their reporting obligations.

Reform of the International Financial Architecture

The international financial architecture (IFA) we know today has existed for around 80 years. Its mission is to promote economic growth, financial stability, and international co-operation. In recent decades, however, clear deficits have surfaced. This includes the structure of the World Bank and the International Monetary Fund, the lack of transparency and inefficiency of the IFA, and its contribution to global justice. Calls for reform have intensified in the wake of the climate crisis, demanding to redirect international capital flows towards the sustainable development of low- and middle-income countries.

Germanwatch is enabling this process through various activities, including producing publications, engaging in dialogues with decision-makers, and encouraging the exchange of political parties on sustainable finance. To ensure we continue to strengthen the voice of the Global South, which is particularly important to Germanwatch, we pursue our intensive dialogues with partners at the local level.

Green Finance Roundtable

Germanwatch organises a monthly networking and exchange meeting on sustainable finance between NGOs and think tanks, the Green Finance Roundtable. The Roundtable is always looking for new members. Contact at meyer@germanwatch.org.

Wichtige Publikationen

Die EU-Taxonomie: Fortschritte, Versäumnisse und aktueller Stand der Dinge

Consistency Case Study: Actions Supporting Article 2.1c of the Paris Agreement in Germany

Reform of the International Financial Architecture

Summit for a New Global Financing Pact

The Summit for a New Global Financial Pact: Outcomes and Challenges (Brot für die Welt)

Supporters of Germanwatch in this field of work (excerpt):